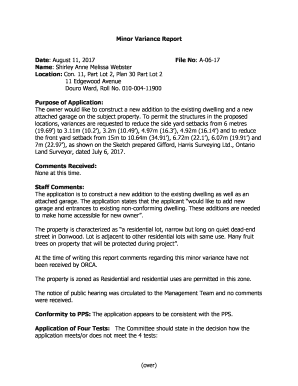

NY IA 198.P 2013 free printable template

Show details

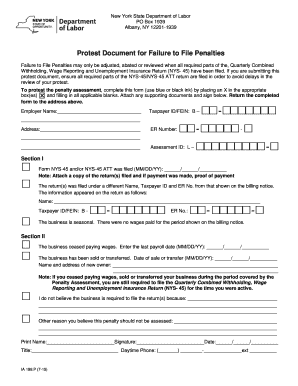

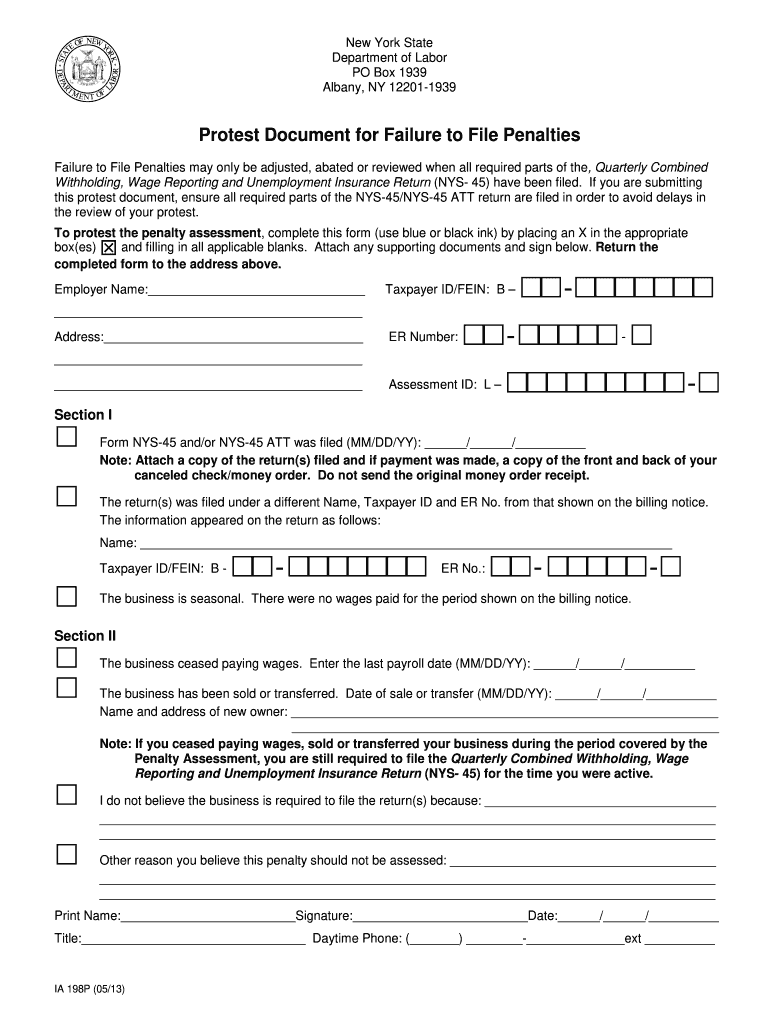

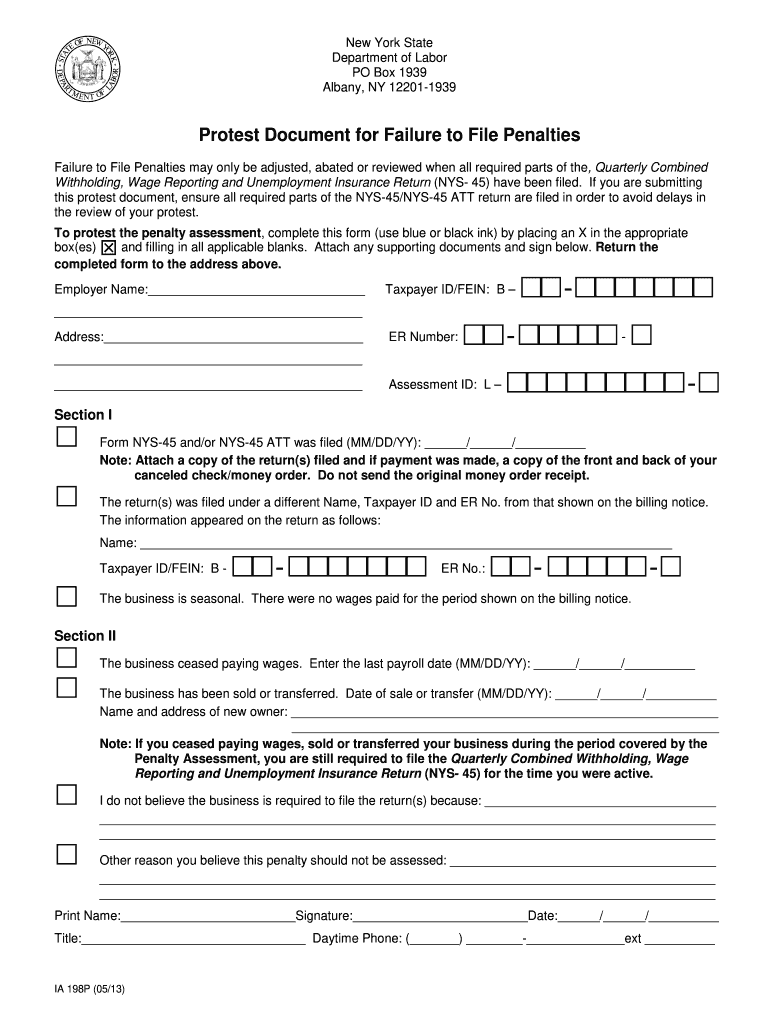

New York State Department of Labor

PO Box 1939

Albany, NY 122011939Protest Document for Failure to File Penalties

Failure to File Penalties may only be adjusted, abated or reviewed when all required

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your nys form i 198p form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nys form i 198p form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nys form i 198p online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nys form i 198p. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

NY IA 198.P Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nys form i 198p

How to fill out nys form i 198p:

01

Begin by carefully reading the instructions and requirements outlined on the form. Make sure you understand all the information required for each section.

02

Provide your personal information accurately, including your full name, address, Social Security number, and any other requested details. Double-check for any spelling errors or missing information.

03

Fill out the sections regarding your income, including sources of income, deductions, and exemptions. Be sure to provide all necessary documentation to support your claims.

04

If applicable, indicate any credits or payments you are entitled to, such as tax credits for child care expenses or student loan interest deductions. Again, ensure you have the necessary documentation to back up these claims.

05

Carefully review all the information you have provided before submitting the form. Make sure everything is accurate and complete.

06

Sign and date the form.

07

Retain a copy of the completed form for your records.

Who needs nys form i 198p:

01

Individuals who are residents of New York State and are required to file a personal income tax return.

02

Residents who have income from sources within New York State, regardless of where they live.

03

Individuals who meet certain criteria outlined by the New York State Department of Taxation and Finance, such as having a certain level of income, receiving specific types of income, or claiming certain tax credits or deductions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nys form i 198p?

NYS Form I-198P is a form used in New York State for the purpose of documenting a police officer's disposition and follow-up on domestic violence incidents. It is specifically used by police officers to report their actions and observations when responding to domestic violence calls. The form helps in documenting details of the incident, including information about the victim, the offender, any injuries, and actions taken by the officer. It is used for record-keeping and to ensure proper handling and follow-up of domestic violence cases.

Who is required to file nys form i 198p?

Form IT-198P, New York State Depreciation Schedule for Pollution Control Property, should be filed by taxpayers who own or lease qualified pollution control property and claim a credit for qualified investments in pollution control property. This form is used to calculate the credit amount that can be claimed on Form IT-201 or IT-203.

How to fill out nys form i 198p?

Form I-198P is used to request a certified copy of a New York State birth certificate for individuals born in New York City. Here are the steps to fill out the form:

1. Download the form: Visit the New York City Department of Health website or contact the department to obtain a copy of Form I-198P. It may also be available at local government offices or public health departments.

2. Personal information: Fill in your personal information in the "Applicant Information" section of the form. This includes your name, address, phone number, email address, and your relationship to the individual named on the birth certificate.

3. Birth certificate information: Provide the full name of the person whose birth is being requested, as well as their date of birth and place of birth (city, borough, and country/state).

4. Request details: Indicate the reason for the request by selecting the appropriate box. Options include personal records, genealogy, legal matters, and other reasons.

5. Proof of identity: Provide your full name and attach a photocopy of your valid, government-issued photo identification (e.g., driver's license, passport, or state ID card). The identification must show your current residential address.

6. Relationship proof: If the birth certificate belongs to someone other than yourself, provide proof of relationship or legal interest. For example, if you are requesting your parent's or grandparent's birth certificate, you may need to attach your birth certificate or a marriage certificate.

7. Notarization: Complete the notarization section of the form in the presence of a qualified notary public. This typically includes signing the form and having the notary public stamp and sign it.

8. Fee payment: Check the current fee and include a money order or certified check payable to the "Department of Health and Mental Hygiene." Do not send cash or personal checks.

9. Mailing address: Mail the completed form, along with the required fee payment and identification proofs, to the address specified on the form or provided by the New York City Department of Health. Make sure to keep a photocopy of the completed form for your records.

10. Processing time: The processing time varies, so check the New York City Department of Health website or contact them to inquire about the estimated turnaround time.

It's important to note that the instructions provided here offer a general guideline for filling out Form I-198P. It is recommended to review the official instructions provided with the form and follow any specific requirements or guidelines mentioned.

What is the purpose of nys form i 198p?

Form I-198P, officially known as the "Certificate of Professional Education" or "Educational Facility Questionnaire," is a document used by the New York State Department of Education (NYSED).

The purpose of Form I-198P is to gather information from educational facilities, such as colleges, universities, or trade schools, to determine if they meet the state's educational requirements for professional licensure or certification programs. This form helps the NYSED assess whether an institution's program aligns with the necessary educational standards set for specific professions.

Educational facilities are typically required to complete this form when seeking approval from the NYSED to offer specific programs or courses that lead to professional licensure or certification in fields like nursing, teaching, architecture, engineering, and others. The information provided in the form helps the NYSED evaluate and confirm the quality of the institution's educational offerings before granting approval or certification.

What information must be reported on nys form i 198p?

Form I-198P, also known as the New York State Preparer's Tax Identification Number Application, is used by paid tax return preparers to apply for a New York State Preparer Tax Identification Number (PTIN). When filing this form, the following information must be reported:

1. Personal Information: This includes your full name, Social Security Number or Individual Taxpayer Identification Number, date of birth, home address, email address, and phone number.

2. Business Information: If you have a business, you need to provide its name, address, and phone number.

3. Credentials: Any relevant credentials or licenses held by the tax preparer, such as Certified Public Accountant (CPA) or Enrolled Agent (EA), have to be listed.

4. Compliance Information: You have to indicate whether you have ever been convicted of a crime or experienced any disciplinary action related to tax matters. Any investigations or pending criminal prosecutions must also be disclosed.

5. Electronic Filing Information: If you plan to e-file tax returns, you need to provide your Electronic Filing Identification Number (EFIN), Electronic Transmitter Identification Number (ETIN), or the software Universal Agent ID number.

6. Acknowledgment: By signing the form, you certify that the information provided is accurate and complete. You also authorize the New York State Department of Taxation and Finance to contact any organization or person to verify the details you have provided.

The specific requirements may vary, and it is always recommended to refer to the official instructions and guidelines provided by the New York State Department of Taxation and Finance when completing Form I-198P.

When is the deadline to file nys form i 198p in 2023?

The deadline to file NYS Form IT-198P in 2023 would most likely be April 17, 2023. However, it is always recommended to double-check with the New York State Department of Taxation and Finance or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of nys form i 198p?

The penalty for the late filing of NYS Form I-198P (Annual Report of Public Authorities) is $1,000. However, it's important to note that this information is based on the assumption that no changes have been made to the penalty since the time of this response. It is always recommended to consult the official sources or seek professional advice for the most up-to-date and accurate information.

How do I execute nys form i 198p online?

Completing and signing nys form i 198p online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in nys form i 198p without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your nys form i 198p, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete nys form i 198p on an Android device?

On Android, use the pdfFiller mobile app to finish your nys form i 198p. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your nys form i 198p online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.